Producer Price Index for Manufacturing (2018=100) April 2024

|

Table A Year-on-Year and Month-on-Month Growth Rates of Producer Price Index: November 2015 and October 2015 |

||

|---|---|---|

|

TOTAL MANUFACTURING |

November

2015

|

October

2015

|

|

Producer Price Index (2000=100) |

139.8 |

139.3 r |

|

Year-on-Year Growth |

-6.0 |

-7.5 r |

|

Month-on-Month Growth |

0.4 |

-0.4 |

- Producer Price Index decreases in November 2015

Producer Price Index (PPI,)for manufacturing declined by 6.0 percent in November 2015. During the same period last year, it decelerated by 2.0 percent. This was brought about by the significant decrements of five major sectors namely:

On a month-on-month performance, the PPI advanced 0.4 percent after decreasing by 0.4 percent a month earlier. Eleven major sectors pulled-up the monthly PPI led by non-metallic mineral products (4.1%). Moreover, five major sectors remained flat while four sectors posted decrements. Refer to Tables 1 and A-2.

TABLE A-1 Producer Price Index, October 2015 and November 2015:

(2000=100)

|

Gainers |

Year-on-Year Growth (percent) |

|

|---|---|---|

|

November 2015 |

October2015

(revised)

|

|

|

Beverages |

2.9 |

8.0 |

|

Chemical Products |

2.5 |

2.4 |

|

Machinery except Electrical |

2.0 |

1.2 |

|

Miscellaneous Manufactures |

5.8 |

4.6 |

|

Fabricated Metal Products |

2.9 |

1.7 |

|

Paper and Paper Products |

3.4 |

3.1 |

|

Food Manufacturing |

0.2 |

0.1 |

|

Textiles |

1.5 |

1.5 |

|

Leather Products |

0.9 |

0.9 |

|

Losers |

Year-on-Year Growth (percent) |

|

|---|---|---|

| November 2015 |

October 2015

(revised)

|

|

|

Electrical Machinery |

-16.6 |

-19.1 |

|

Petroleum Products |

-11.8 |

-17.0 |

|

Basic Metals |

-11.1 |

-10.7 |

|

Wood and Wood Products |

-17.0 |

-17.9 |

|

Rubber and Plastic Products |

-4.1 |

-4.2 |

|

Tobacco Products |

-3.6 |

0.9 |

|

Non-Metallic Mineral Products |

-1.9 |

-6.5 |

|

Footwear and Wearing Apparel |

-2.5 |

-2.2 |

|

Printing |

-1.7 |

-1.7 |

|

Transport Equipment |

-0.7 |

0.6 |

|

Furniture and fixtures |

-27.7 |

-34.1 |

(2000=100)

|

Gainers |

Month-on-Month Growth (percent) |

|

|---|---|---|

| November 2015 |

October 2015

(revised)

|

|

|

Non-Metallic Mineral Products |

4.1 |

-0.1 |

|

Petroleum Products |

1.0 |

-0.8 |

|

Electrical Machinery |

0.5 |

-1.2 |

|

Machinery except Electrical |

0.9 |

-0.3 |

|

Miscellaneous Manufactures |

0.7 |

-1.2 |

|

Transport Equipment |

0.1 |

0.4 |

|

Rubber and Plastic Products |

0.1 |

0.0 |

|

Paper and Paper Products |

0.2 |

-1.5 |

|

Furniture and Fixtures |

0.4 |

-0.5 |

|

Fabricated Metal Products |

0.1 |

1.3 |

|

Chemical Products |

a/ |

-0.4 |

|

Beverages |

0.0 |

0.0 |

|

Tobacco |

0.0 |

0.0 |

|

Textiles |

0.0 |

0.0 |

|

Printing |

0.0 |

0.0 |

|

Leather Products |

0.0 |

-0.2 |

|

Losers |

Month-on-Month Growth (percent) |

|

|---|---|---|

| November 2015 |

October 2015

(revised)

|

|

|

Basic Metals |

-0.8 |

0.1 |

|

Food Manufacturing |

-0.1 |

0.0 |

|

Footwear and Wearing Apparel |

-0.3 |

-1.9 |

|

Wood and Wood Products |

-0.2 |

0.6 |

- Introduction

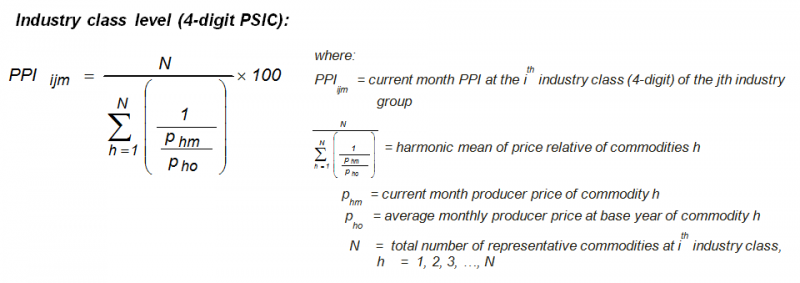

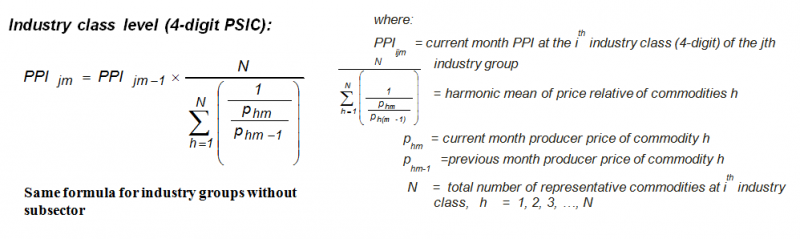

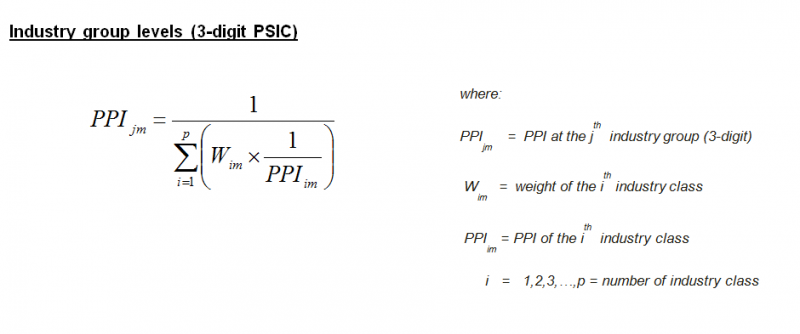

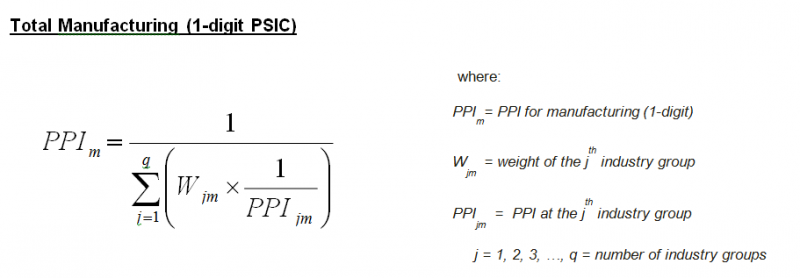

- Method of Index Computation

- Industry Coverage

Starting with January 2013 reference month, the PPI utilizes the 2009 Philippine Standard Industry Classification (PSIC) to classify sectors and industries. Selected industry classes of the 2009 PSIC were grouped to form the 20 industry groupings of the 2014 PPS. These are presented in the table below.

|

2009 PSIC CODE |

INDUSTRY DESCRIPTION |

|---|---|

|

C10 |

Food manufacturing * |

|

C11 |

Beverages |

|

C12 |

Tobacco products |

|

C13 |

Textiles* |

|

C14,C152 |

Footwear and wearing apparel |

|

C151 |

Leather products |

|

C16 |

Wood and wood products* |

|

C17 |

Paper and paper products |

|

C18 |

Printing and reproduction of recorded media |

|

C19 |

Petroleum products* |

|

C20,C21 |

Chemical products* |

|

C22 |

Rubber and plastic products* |

|

C23 |

Non-metallic mineral products* |

|

C24 |

Basic Metals* |

|

C25 |

Fabricated metal products |

|

C262,C275,C28,C263,C268 |

Machinery except electrical* |

|

C261,C264,C27,C29301 |

Electrical machinery* |

|

C29 except C29301,C30 |

Transport equipment |

|

C31 |

Furniture and fixtures |

|

C265,C266,C267,C32 |

Miscellaneous manufactures |

Note: * - Major sectors categorized into sub-sectors

- Response Rate

The response rate for November 2015 is 79.0 percent, which corresponds to the retrieval of 575 establishments’ reports out of the 728 samples for the survey. Refer to Table B.

|

Table B Response Rates For Total Manufacturing

(In Percent)

|

|

|---|---|

|

November 2015 |

October 2015

(revised)

|

|

79.0 |

89.4r |

Missing prices for products of sample establishments are estimated using the short-term geometric mean of the actual prices of responding samples within the same industry class. Revisions to the preliminary estimates are done upon receipt of actual reports from late responding establishments.