Number of Establishments

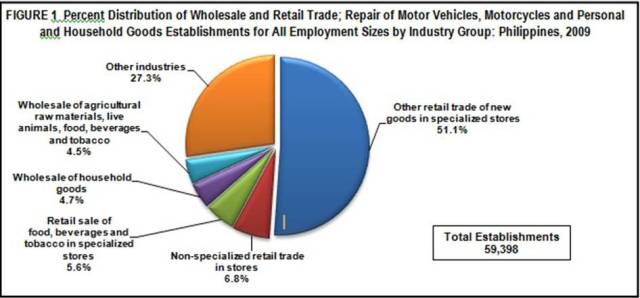

Based on the final results of the 2009 Annual Survey of Philippine Business and Industry, the Philippines had a total of 59,398 establishments engaged in the Wholesale and Retail Trade; Repair of Motor Vehicles, Motorcycles and Personal and Household Goods. Other retail trade of new goods in specialized store (excluding computers and non-customized computer software) industries led the sector with 30,364 (51.1%) establishments. Figure 1 shows the percent distribution of establishments by industry group in 2009.

Employment

Wholesale and retail trade; repair services sector in 2009 provided employment to 691,160 workers. Of the total workforce, paid employees comprised 662,463 (95.8 %).

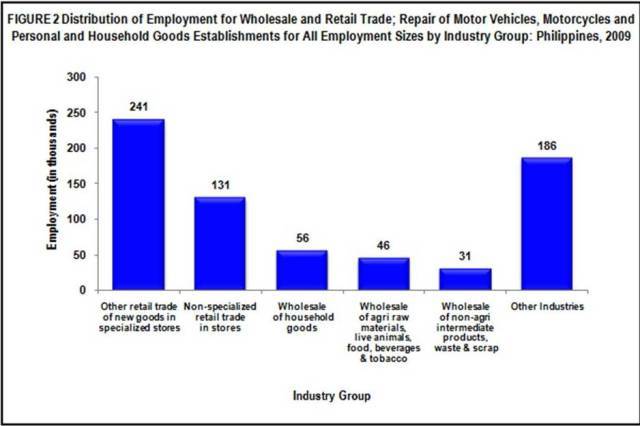

Among industry groups, Other retail trade of new goods in specialized stores (excluding computers and non-customized software) recorded the highest number of employees with 240,782 (34.8%) workers. Non-specialized retail trade in stores and Wholesale of household goods ranked second and third with 130,886 (18.9%) and 56,140 (8.1%) workers, respectively. Figure 2 shows the distribution of employment by industry group.

The sector's average number of workers per establishment stood at 12 workers per establishment. Wholesale of computers, computer peripheral equipment and software registered the highest average at 43 workers per establishment. Three other industries with high average were Non-specialized retail trade in stores, Sale of motor vehicles and Wholesale of electronic parts and equipment with 32, 26 and 23 workers per establishment, respectively.

Compensation

Total compensation paid by Wholesale and retail trade; repair services sector amounted to PHP89.6 billion, an equivalent of PHP135,325 average annual compensation.

By industry group, Other retail trade of new goods in specialized stores (excluding computers and non-customized software) paid the highest compensation to its employees amounting to PHP25.5 billion or 28.5 percent of the total. Next is the Non-specialized retail trade in stores paying PHP13.9 billion or 15.5 percent while Wholesale of household goods is the third highest paying industry with PHP13.2 billion (14.7%).

Wholesale of computers, computer peripheral equipment and software employees were the highest earners in 2009 with an average annual compensation of PHP 301,270. Employees of Wholesale of electronic parts and equipment and Wholesale of household goods followed next with PHP259,545 and PHP237,740, respectively. On the other hand, Retail sale of secondhand goods in stores employees received the lowest annual pay of PHP78,273. Figure 3 shows the leading industries in average annual compensation by industry group in 2009.

Revenue

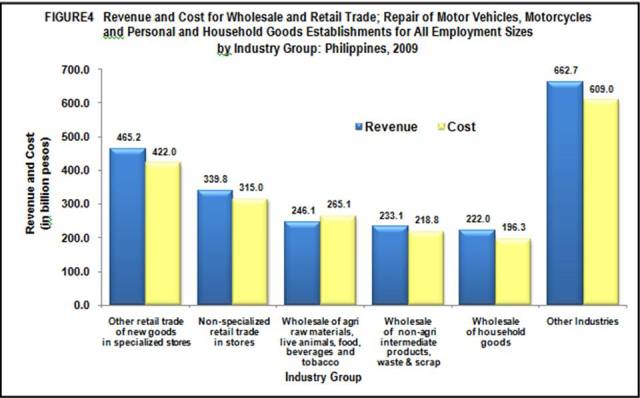

Gross revenue for the sector in 2009 was estimated at PHP2.2 trillion. The top revenue generators of the sector were the following: Other retail trade of new goods in specialized stores (excluding computers and non-customized software) earned PHP465.2 billion (21.4%); Non-specialized retail trade in stores with PHP339.8 billion (15.7%) and Wholesale of agricultural raw material, live animals, food, beverages and tobacco with PHP246.1 billion (11.3%).

Cost

Cost for operating the sector less compensation totaled to PHP2.0 trillion. Other retail trade of new goods in specialized stores (excluding computers and non-customized software) establishments spent the most at PHP422.0 billion. Non-specialized retail trade in stores incurred the second highest cost at PHP315.0 billion (15.5%) followed by Wholesale of agricultural raw material, live animals, food, beverages and tobacco at PHP265.1 billion (13.1%). Figure 4 shows the distribution of revenue and cost by industry group for the sector in 2009.

Revenue per Cost

The revenue generated an amount of PHP1.07 for every peso cost for the sector. Among industries, Wholesale of other machinery, equipment and supplies recorded the highest revenue-cost ratio with 1.29 followed by Maintenance and repair of motor vehicles, Wholesale on a fee or contract basis and Wholesale of machinery, equipment and supplies all with 1.18. Repair of personal and household goods with 1.17 came in third.

Value Added

Value added is defined as gross output minus intermediate cost or the spread between the value of goods/services produced and intermediate consumption. Value added of the sector was estimated at PHP217.7 billion. More than half (59.2%) or PHP128.8 billion of the total value added of the sector was contributed by the following industry groups: Other retail trade of new goods in specialized stores (excluding computers and non-customized software) with PHP60.9 billion (28.0%); Non-specialized retail trade in stores with PHP35.0 billion (16.1%) and Wholesale of household goods with PHP33.0 billion (15.1%).

Labor Productivity

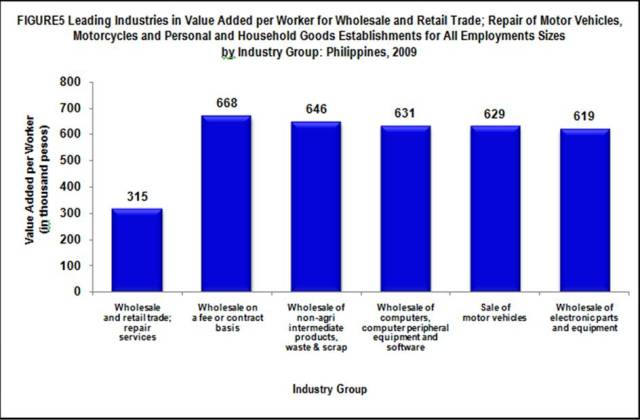

Labor productivity is the ratio of value added to total employment. It measures the value added generated per unit of labor. Wholesale and retail trade; repair services sector generated labor productivity ratio of PHP314.9 thousand per worker. Workers of Wholesale on a fee or contract basis establishments were the most productive in terms of contribution to value added per worker with PHP668.0 thousand, twice more than the national average. Other industries that registered almost doubled than the national average were the following: Wholesale of non-agricultural intermediate products waste and scrap with PHP645.6 thousand; Wholesale of computers, computer peripheral equipment and software with PHP631.2 thousand and Sale of motor vehicles with PHP628.5 thousand. Figure 5 shows the value added per worker by industry group of the sector for 2009.

Gross Margin

Gross margin or trade margin, the gross output of the sector in 2009 reached PHP335.6 billion. Other retail trade of new goods in specialized stores (excluding computers and non-customized software led as the top grosser contributing the highest among industries with PHP93.0 billion (27.7%). Non-specialized retail trade in stores followed with PHP53.9 billion (16.1%) and Wholesale of household goods came in third with PHP53.2 billion (15.8%). The percent distribution of industries to gross margin is shown in Figure 6.

Gross Additions to Tangible Fixed Assets

Gross additions to tangible fixed assets in 2009 totaled to PHP16.9 billion of which, Other retail trade of new goods in specialized stores (excluding computers and non-customized software) contributed the highest among industries with PHP6.2 billion (36.4%). Non-specialized retail trade in stores followed with PHP3.7 billion (21.8%) and Wholesale of household goods with PHP1.5 billion (9.0%).

Change in Inventory

Change in inventories, defined as the value of ending inventory less beginning, amounted to PHP30.0 billion in 2009. Among industries of the sector, Other retail trade of new goods in specialized stores (excluding computers and non-customized software) recorded the highest with PHP8.9 billion, while five industries reported negative inventories amounting to PHP678.3 million.

Subsidies

Subsidies are special grants received from the government in the form of financial assistance or tax exemption or tax privilege to aid and develop an industry. For 2009, a total of PHP22.4 billion was granted to the sector of which only Wholesale of agricultural raw materials, live animals, food, beverages and tobacco establishments availed the government subsidies.

TECHNICAL NOTES

Introduction

The 2009 Annual Survey of Philippine Business and Industry (ASPBI), conducted in 2010 with 2009 as reference year, is one of the continuing activities of the National Statistics Office. It will be a source of benchmark levels on the structure and trends of economic activities in the country for the year 2009. Particularly, the data from ASPBI will be used in constructing national and regional income accounts in the country, determining and comparing regional economic structures, and formulating plans and policies of the government in the attainment of economic goals.

The conduct of the ASPBI is governed by legislative acts and presidential directives, specifically Commonwealth Act No. 591 which was approved on August 19,1940.

Scope and coverage

The 2009 ASPBI covered establishments engaged in 14 economic sectors classified under the Amended 1994 Philippine Standard Industrial classification (PSIC) namely:

- A - Agriculture, Hunting and Forestry

- B - Fishing

- C - Mining and Quarrying

- D - Manufacturing

- E - Electricity, Gas and Water Supply

- F - Construction

- G - Wholesale and Retail Trade, Repair and Maintenance of Motor Vehicles, Motorcycles, and Personal and Household Goods

- H - Hotels and Restaurants

- I - Transportation, Storage and Communications

- J - Financial Intermediation

- K - Real Estate, Renting and Business Activities

- M - Private Education

- N - Health and Social Work

- O - Other Community, Social and Personal Service Activities

The scope of the ASPBI was confined to the "formal sector" only consisting of the following:

- Corporations and partnership

- Cooperatives and foundations

- Single proprietorships with employment of 10 or more

- Single proprietorships with branches

Like all other establishment surveys conducted by the NSO, the 2009 ASPBI used establishment as the unit of enumeration. It is defined as "an economic unit under a single ownership or control, i.e. under a single legal entity, engaged in one or predominantly one kind of economic activity at a single fixed location."

Classification of Establishments

Before the actual selection of samples, the establishments listed in the frame were classified based on economic organization (EO), legal organization (LO), industrial classification, employment size and geographic location.

Economic organization refers to the organizational structure or role of the establishment in the organization. The following are the types of economic organization:

- Single establishment is an establishment which has neither branch nor main office

- Branch only is an establishment which has a separate main office located elsewhere

- Establishment and main office, both located in the same address and with branches elsewhere

- Main office only is the unit which controls, supervises and directs one or more establishments of an enterprise

- Ancillary unit other than main office is the unit that operates primarily or exclusively for a related establishment or group of related establishments or its parent establishment and provide goods or services that support but do not become part of the output of those establishments

The legal organization provides the legal basis for ownership of the establishment. The following are the types of legal organization:

- Single Proprietorship refers to a business establishment organized, owned, and managed by one person, who alone assumes the risk of the business enterprise. The establishment name is that of a person, or it has words such as Owner, Proprietor or Operator.

- Partnership refers to an association of two or more individuals for the conduct of a business enterprise based upon an agreement or contract between or among them to contribute money, property or industry into a common fund with the intention of dividing profits among themselves. The establishment name includes words such as Owners, Partners, Limited or LTD., Associates or ASSOCS.

- Government Corporation is a private corporation organized for private aim, benefit or purpose and owned and controlled by the government. The establishment name included words such as Corporation or CORP., INCORPORATED or INC.

- Private Corporation is a corporation organized by private persons. The establishment name includes words such Corporation or Corp, Incorporated or INC.

- Cooperative - the establishment name includes words such as Cooperative or COOP

The industrial classification of an economic unit is determined by the activity from which it derives its major income or revenue. The amended 1994 PSIC is utilized to classify units according to their economic activities.

The amended 1994 PSIC consists of an alpha character and 5 numeric digits. The alpha character, which represents the major division, is denoted by the characters A to Q. The first two numeric digits represent the division; the first three numeric digits, the group; the first four digits, the class; and the 5 digits, the sub-class.

The size of the establishment is determined by its total employment (TE). The following are the employment size classification used in the 2009 ASPBI:

| 0 | 1 - 4 | 5 | 100 - 199 |

| 1 | 5 - 9 | 6 | 200 - 499 |

| 2 | 10 - 19 | 7 | 500 - 999 |

| 3 | 20 - 49 | 8 | 1000 - 1999 |

| 4 | 50 - 99 | 9 | 2000 and Over |

| TE Code | Total Employment | TE Code | Total Employment |

The geographic or physical location of the establishments was classified in accordance with the Philippine Standard Geographic Code (PSGC) as of December 30, 2006 which contains the latest updates on the number of regions, provinces, cities, municipalities and barangays in the Philippines.

The geographic domains of the 2009 ASPBI for establishments with TE of 20 and over are the 17 administrative regions while the whole country serves as the geographic domain for establishments with TE of less than 20.

Hence, the samples of the 2009 ASPBI with TE of 20 and over shall provide data for 17 administrative regions. For samples with TE of less than 20, the data that will be presented is limited only at the national level.

Response Rate

A total of 5,544 or 90.9 percent of sample establishments responded. These include receipts of "good" questionnaires, partially accomplished questionnaires, reports of closed, moved out or out of scope establishments.

CONCEPTS AND DEFINITIONS OF TERMS

Economic activity or business is the activity of the establishment as classified under the amended 1994 Philippine Standard Industrial Classification (PSIC). Generally, the main activity of the establishment is the establishment's principal source of income. If the establishment is engaged in several activities, its main activity is that which earns the biggest income or revenue.

Total Employment is the number of persons who worked in or for this establishment as of November 15, 2009.

Paid employees are all persons working in the establishment and receiving pay, as well as those working away from the establishment paid by and under the control of the establishment. Included are all employees on sick leave, paid vacation or holiday. Excluded are consultants, home workers, workers receiving pure commissions only, and workers on indefinite leave.

Salaries and wages are payments in cash or in kind to all employees, prior to deductions for employee's contributions to SSS/GSIS, withholding tax, etc. Included are total basic pay, overtime pay, and other benefits.

Revenue is the value of goods, products/by-products sold and/or services rendered to others whether paid in cash or is considered receivable by the establishment. Valuation of products/by products sold should be in producer's price (ex-establishment), net of discounts and allowances, including duties and charges but excluding subsidies. It also include goods transferred and/or services rendered to other establishment belonging to the same enterprise as the said establishment which should be treated as sales or as if sold to a customer; and revenue from products on a contractual basis from materials supplied by the establishment.

Cost refers to all expenses excluding compensation incurred during the year whether paid or payable. Valuation should be at purchaser price including taxes and other charges, net of discounts, rebates, returns and allowances. Goods received from and services rendered by other establishment of the same enterprise are valued as though purchased.

Cost of goods sold represents the sum of the total value of goods purchased for resale and change in inventory of goods for resale (beginning less ending).

Gross Margin refer to the difference between the value of goods sold on own account (including commission received on sale on account of others) during the inquiry period and the gross cost of these goods. The gross cost of goods is the value of purchased of goods intended for sale adjusted for stock change of these goods during the inquiry period.

Value added is gross output less intermediate costs.

Gross Output is equal to the sum of the total revenue (less rent income from land, delivery charges separately invoiced to customers, interest income, dividend income, royalty income and franchise income), capital expenditures of fixed assets produced on own account and change in inventories of goods for resale ;less cost of goods purchased for resale.

Intermediate costs is equal to the sum of the following cost items: materials and supplies ; fuels, lubricants, oils and greases ; electricity and water ; cost of industrial services done by others; cost of non-industrial services done by others(less rent expense for land);research and experimental development expense; environmental protection expense; royalty fee; franchise fee, inventory of materials and supplies, fuels, lubricants, oils and greases (beginning less ending) and other cost.

Fixed assets are physical assets expected to have productive life of more than one year and intended for use and/or being used by the establishment. Included are land, buildings, other structures and land improvements, transport equipment, fixtures, machinery, tool, furniture, office equipment and other fixed assets.

Book value of tangible fixed assets is the initial value or acquisition cost of fixed assets less the accumulated depreciation.

Gross addition to fixed assets is the sum of costs of new and used fixed assets acquired during the year, cost of alteration and improvements done by others and cost of fixed assets produced by the establishment less the value of sales of fixed assets during the year.

Inventories refer to the stocks of goods owned by and under the control of the establishment as of a fixed date, regardless of where the stocks are located. Valuation should be at current replacement cost in purchaser's price at the indicated dates. Replacement cost is the cost of an item in terms of its present price rather than its original price.

Change in Inventories is equivalent to the total value of inventories at the end of the year less the value at the beginning of the year.

Subsidies are special grants in the form of financial assistance or tax exemption or tax privilege given by the government to aid and develop an industry or production and to protect it against competition.

Source: National Statistics Office

Manila, Philippines